If there is a role, among the many other roles, that any mom is expected to be good at, I personally think that it is being the money manager of the house hence, someone who is good in budgeting.

Admittedly, this is one of the skills I know I need much improvement on. And with the generous invite I got from Mommy Kaye Ang of Mamacademy PH, I did not miss out the chance to learn more about this field.

Last July 28, together with the other moms who were mutually eager to learn more about managing their family’s finances, Money MOMnagement Workshop by Mamacademy PH, in partnership with ManuLife GradMaker was held at the BoardRoom PH, Robins Design Center in Ortigas, Pasig. The event was also co-sponsored by Merries PH and Mother Nurture.

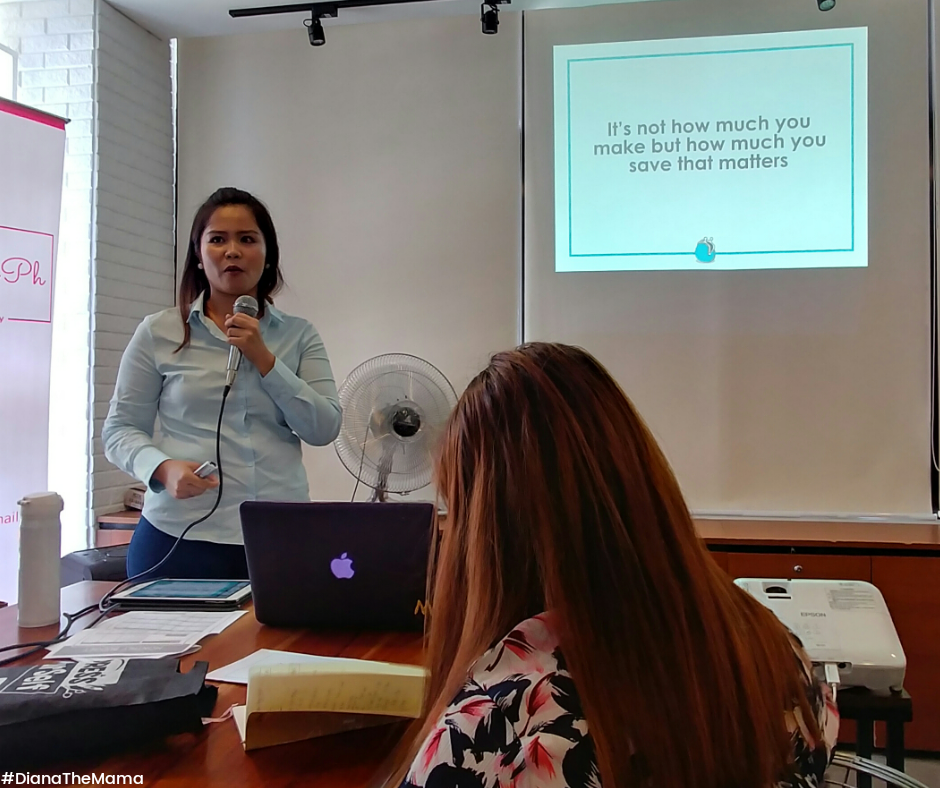

The workshop’s speaker was the award-winning mom blogger behind Tipid Mommy who is a full-time mom and mompreneur, Mommy Gracie Miranda-Maulion.

Though my husband and I, together with our little girl Savia came in a liittle late that day due to heavy rains, I’m hoping that I could still share with you those that I have noted down during the workshop. Also, expect a number of quotations that are worth-capturing and -saving on your phone for future reference. 🙂

So when we arrived at the venue, Mommy Gracie was already sharing some TIPS ON PRACTICAL BUDGETING.

- Create a realistic Budget Plan.

Control your money. Do not let money control you.

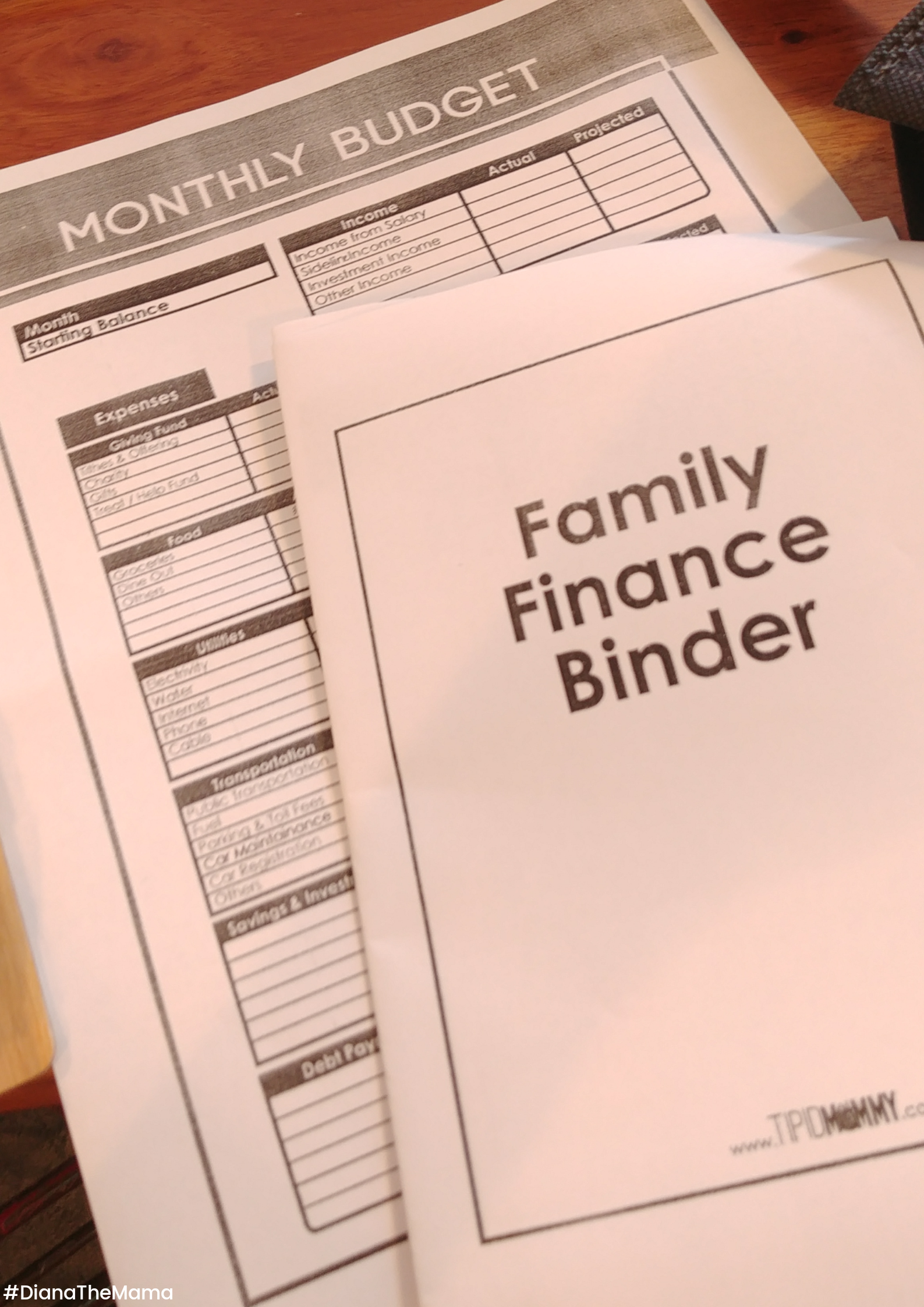

For a more efficient money management, make a monthly budget. – a ManuLife GradMaker tip

Budget is telling your money where to go instead of telling you where it went. — John Maxwell

- CASH VS. CREDIT CARD

- Cash is handy; and not all merchants are accepting credit cards. You may use envelopes or accordion to organize your money.

- Credit Card is okay as long as you can control and monitor your usage properly.

- TIPS ON BUDGETING ON MEAL PLANNING

- Create a Monthly Meal Plan

- It is recommended to buy from the wet market (if any) and look for your suki for better discounts and/or freebies.

- Try to, at least, buy ingredients you would need for the whole week. As mentioned by Mommy Kaye, this way, even the perishable ones can be used up until the last item. List them all down so that you won’t forget buying any of them, because #mombrain ;-p

- It is also highly suggested to stock up frozen meat/meals and even canned goods for emergency purposes (ex. calamities, etc.) and even for those days you just don’t feel like cooking a decent meal. It is totally understandable, moms. 😉

- As suggested by Mommy Vivienne of The Fulfilled Women, who was also the host of the event, what she does is that she offers their weekly menu in restaurant menu style to her husband and kids. She asks them to pick 1 each from the pork and beef and veggies menus. That way, her prepared menu for the week won’t go uneaten. :-p

- Helpful mobile apps were suggested by a mommy at the workshop:

- Shopping Calculator – can compute and project costs on your listed products

- Snapcart – Snap your grocery receipts and earn a legit extra real money only for you. Recommended only to those who go to the grocery malls.

- Create a Monthly Meal Plan

SAVING 101

Saving is income not spent.

- Ways on How to Save Money

- Thru Bank deposit

- Taking a money challenge

- Thru a Coin bank

- Additional Tips on How to Save Money

-

Income – Savings = Expenses

- Save all unexpected incomes (ex. Christmas bonus, incentives, commissions, etc.)

- Change your mindset: SAVE BEFORE SPENDING

- Collect all loose change in a piggy bank. You’ll be surprised on how much you’d be able to collect.

- Less eat-out(!)

- Use discount coupons

- Invest on energy-efficient appliances

- Do-it-Yourself (ex. manicure, pedicure, waxing, etc.)

- Grow your own food (Urban Gardening is also becoming a trend nowadays)

-

Activity: Double check all your current family expenses. What can you eliminate now?

Here are some of the so-called Budget Vampires that moms at the event have discussed within their groups which they’re willing to cut down. *Applies only if at above average frequency and unnecessary/impulsive buying.

- Online shopping

- Coffee (at cafes)

- Me-time (salon, manicure, pedicure, etc.)

- Grab/Taxi/commute

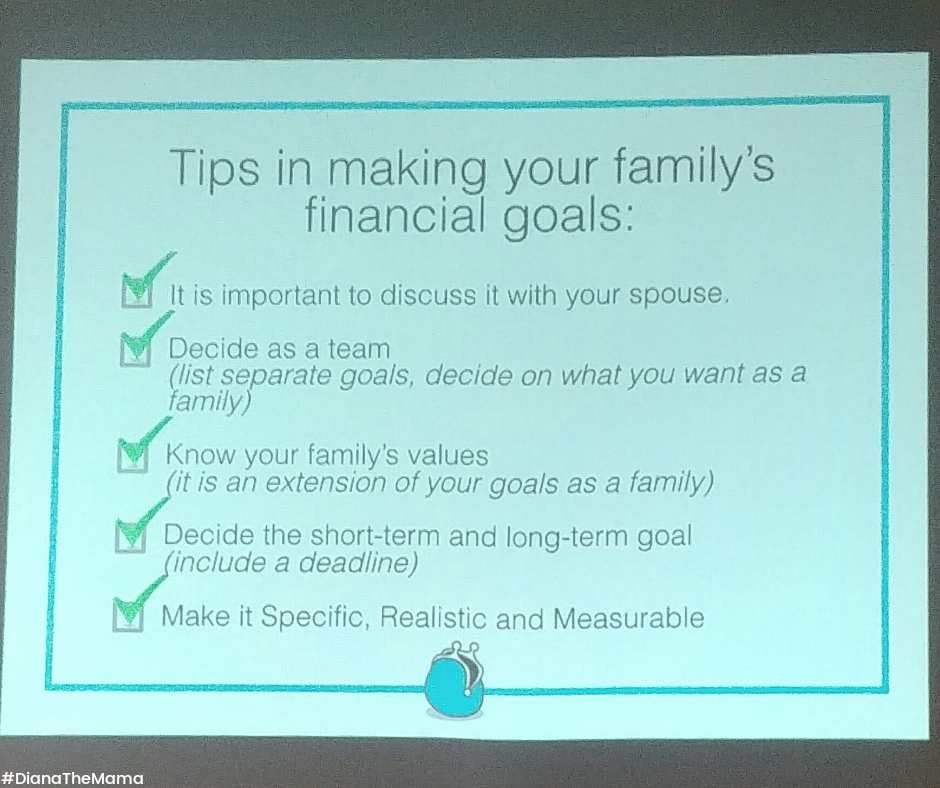

SETTING FAMILY GOALS

- One at a time

EMERGENCY FUND

- Should always comes first in mind

- Monthly income x 6 months = EMERGENCY FUND (ideally, at least)

- Should be accessible at anytime

- It could also become an OPPORTUNITY FUND, for opportunities you might don’t want to miss out (ex. studying or working abroad)

- Include your goal in your budget (ex. vacation, etc.)

- Pay off your debts

TIPS ON MONITORING IN PAYING YOUR DEBTS

- Payment Strategy can include but not limited to: selling of pre-loved stuff, getting payment from husband’s salary, etc.

- Do not forget to include debt payment in your budget.

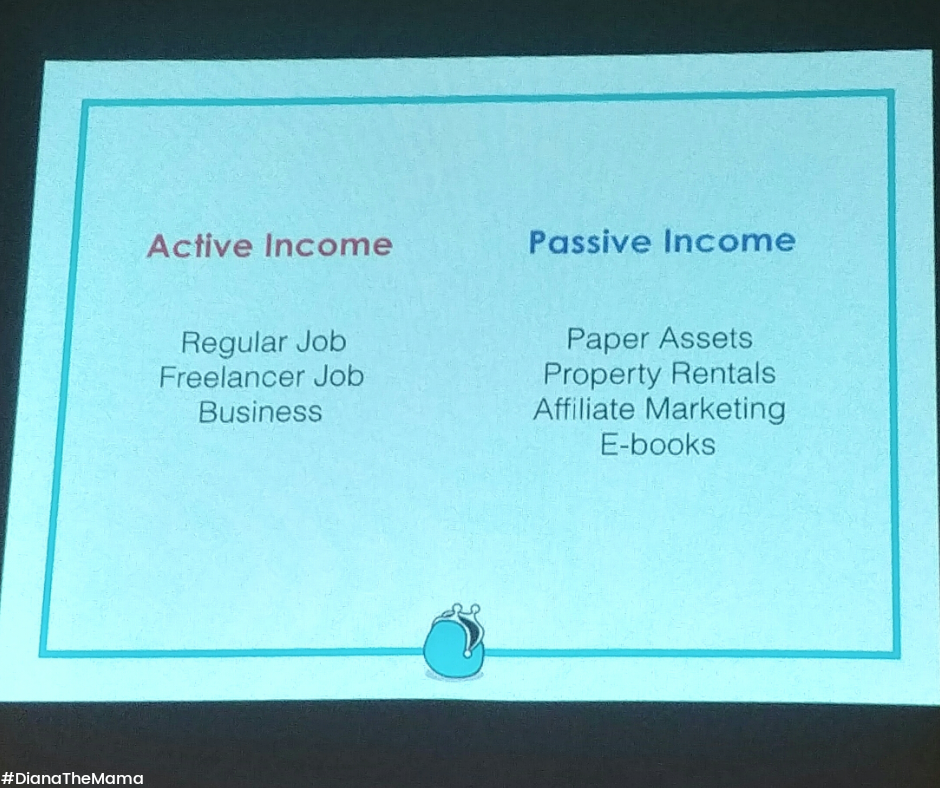

HOW TO INCREASE THE FAMILY’S INCOME (especially for Stay-at-Home Moms or SAHMs)

- Earn from work-from-home (WFH) jobs

- Turn your hobby into an online business

- Be a reseller or an agent (ex. RTW clothes, real estate, goodies, etc.)

- Answer online surveys

- Offer a service that you are good at (ex. event styling or photography, etc.)

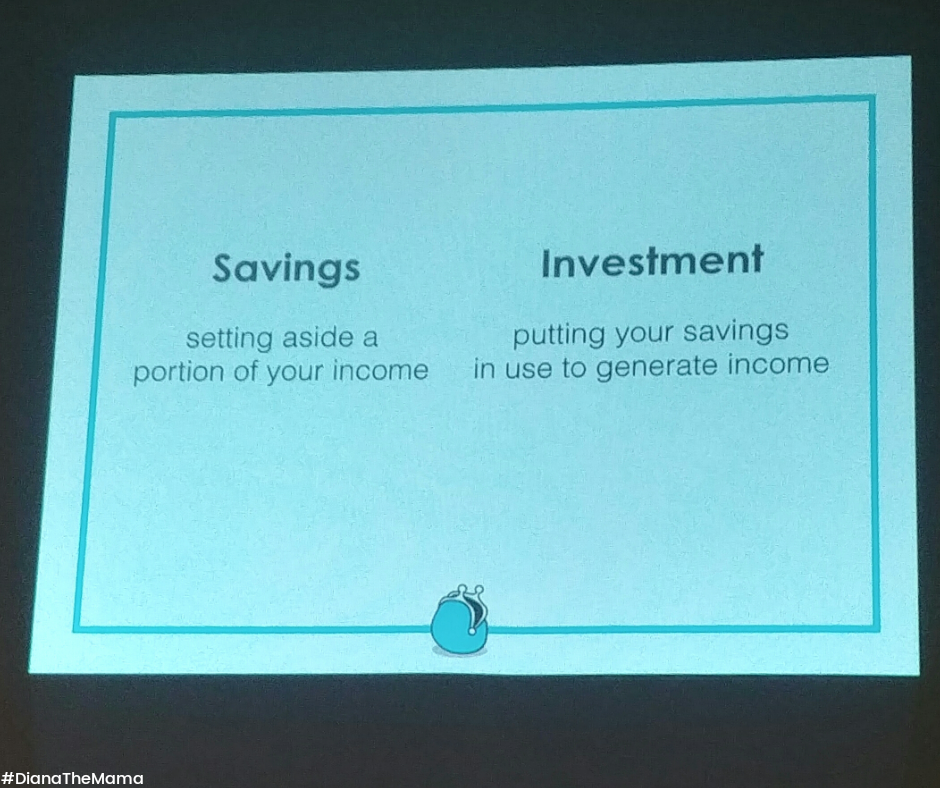

Now, let’s talk about Investment…

BASIC INVESTMENT

- Savings VS. Investment

PAPER ASSETS (stock market, mutual fund, etc.)

- How do I start investing? Just remember P.A.T.

- Purpose (This is your WHY. It could be that you want to buy a bigger house, or you want have a relaxed retirement or want to save up for your kids’ education, etc.)

- Amount (How much are you willing to invest? Experts recommend that at least 20% of your income should go to your investment.)

- Time (Decide on your investment schedule – weekly, monthly or quarterly)

- RISK CAPACITY (low, moderate or high)

- You may take an exam on this from ManuLife to know your capacity.

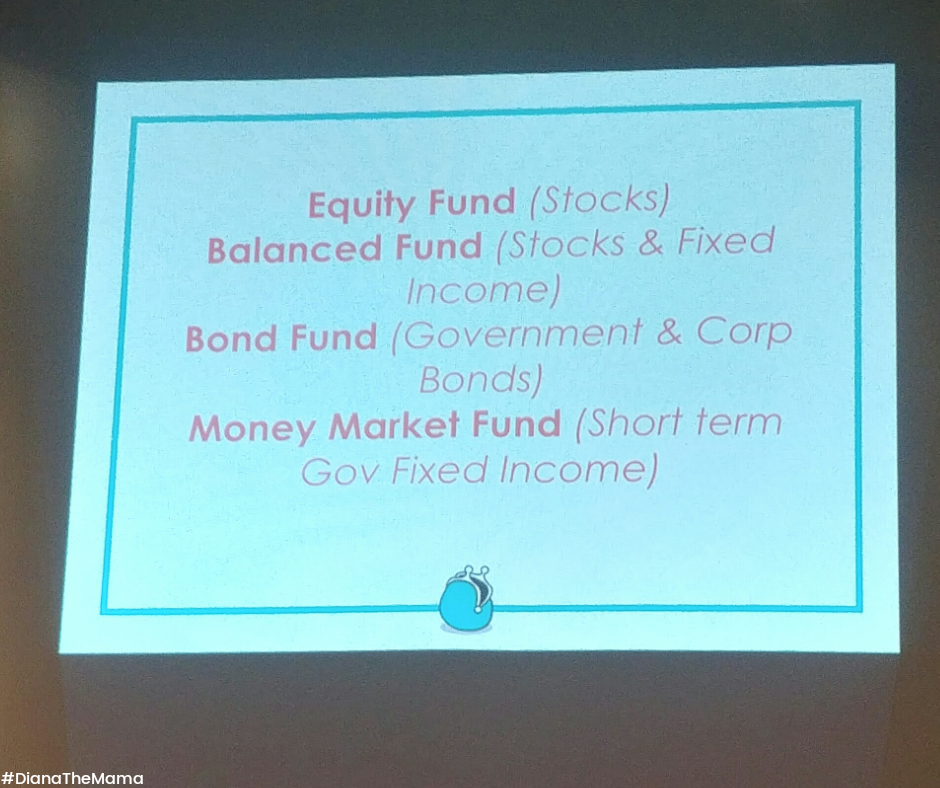

- Low – bonds (government)

- Medium – balanced funds (mutual fund or MF)

- High – stock market

- You may take an exam on this from ManuLife to know your capacity.

- INVESTMENT OPTIONS

- Stock market – gives you an opportunity to have a share of the big companies

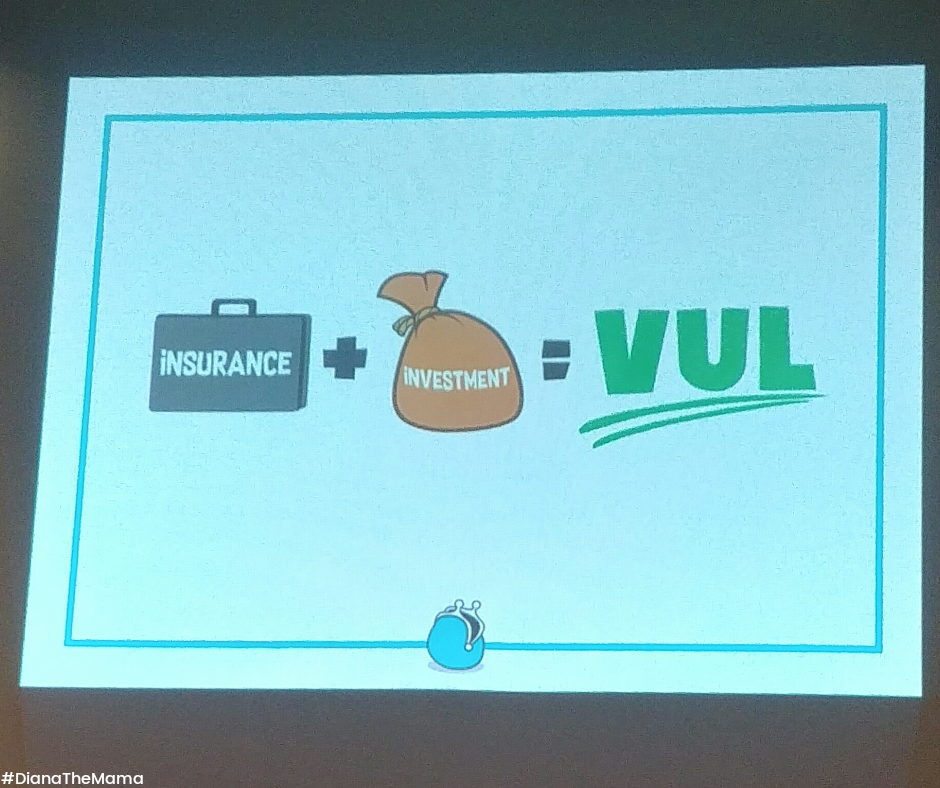

- Variable Universal Life (VUL)

3. Mutual Fund (MF)

4. Other Types of Investment Funds

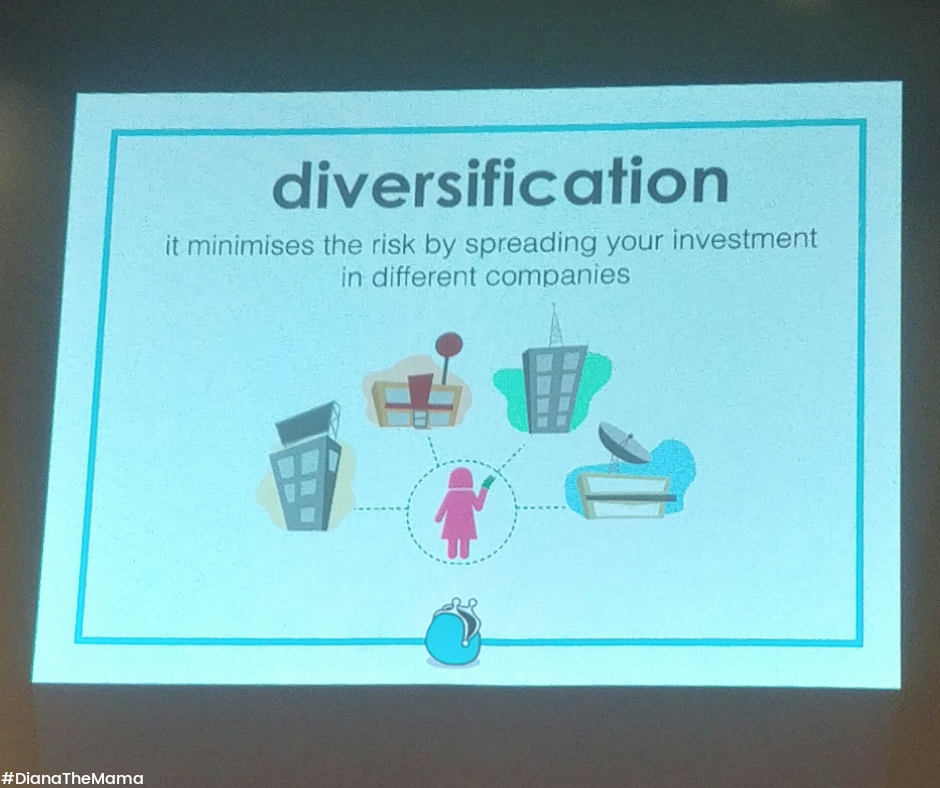

4. Diversification

Why invest in VUL and MF?

- Affordable, managed by professionals

- ManuLife GradMaker is a VUL, a mobile app first of its kind and financial solution for parents who want to invest for their children’s college fund. It is the first digital, end-to-end solution of Manulife that allows you to sign up, invest and purchase policies online, 24/7, without paper forms

- Protection and Investment

- Easy-to-start

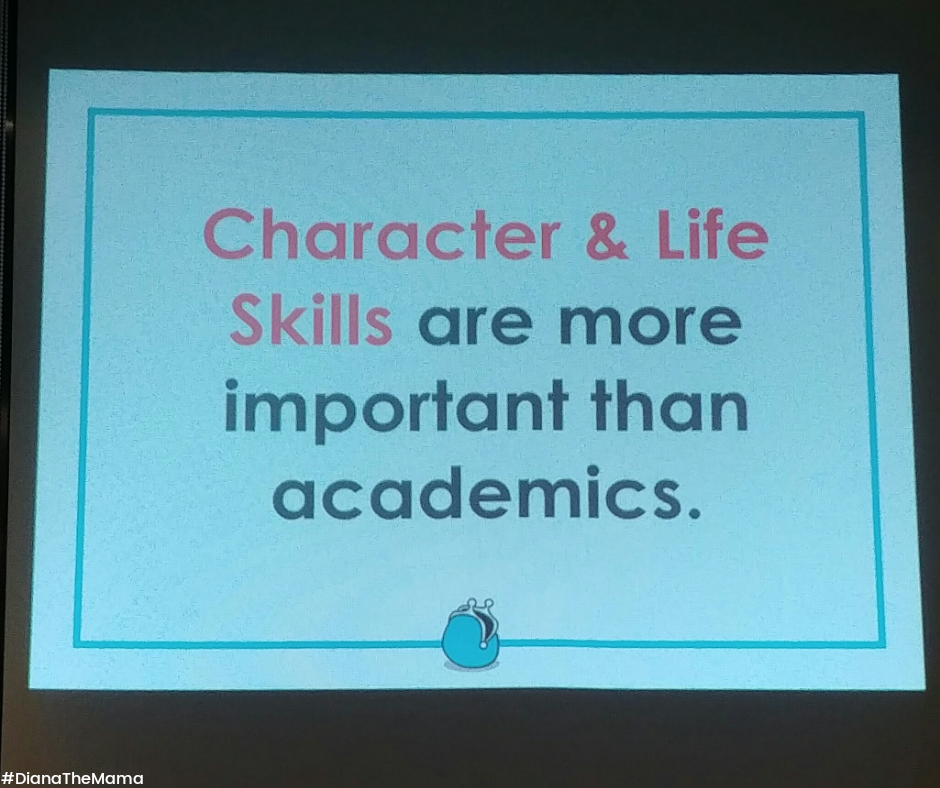

Lastly, here are some Tips on Raising Kids with Money Values.

- Teach them early

- Be a good example

- Break poverty mindset

- Train kids to WAIT (delayed gratification)

- Involve chores that include money

- For example, pretend play that promotes hardwork

- Open a bank account (bring your kid along)

- Introduce the Philippine denominations (may use play money)

At the end of the day…

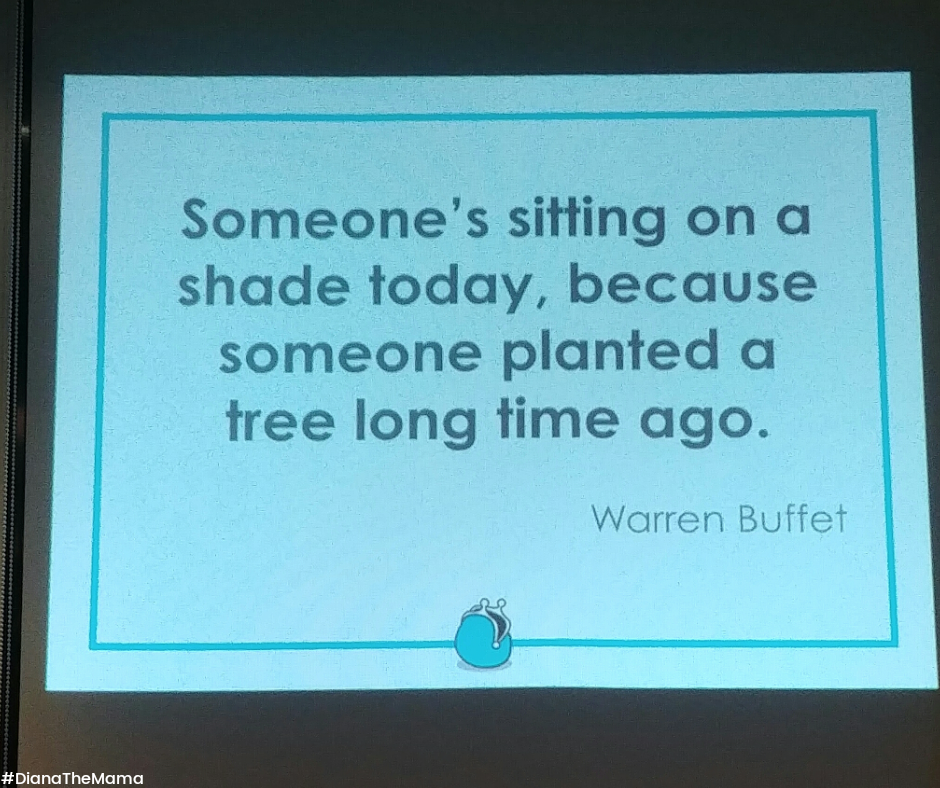

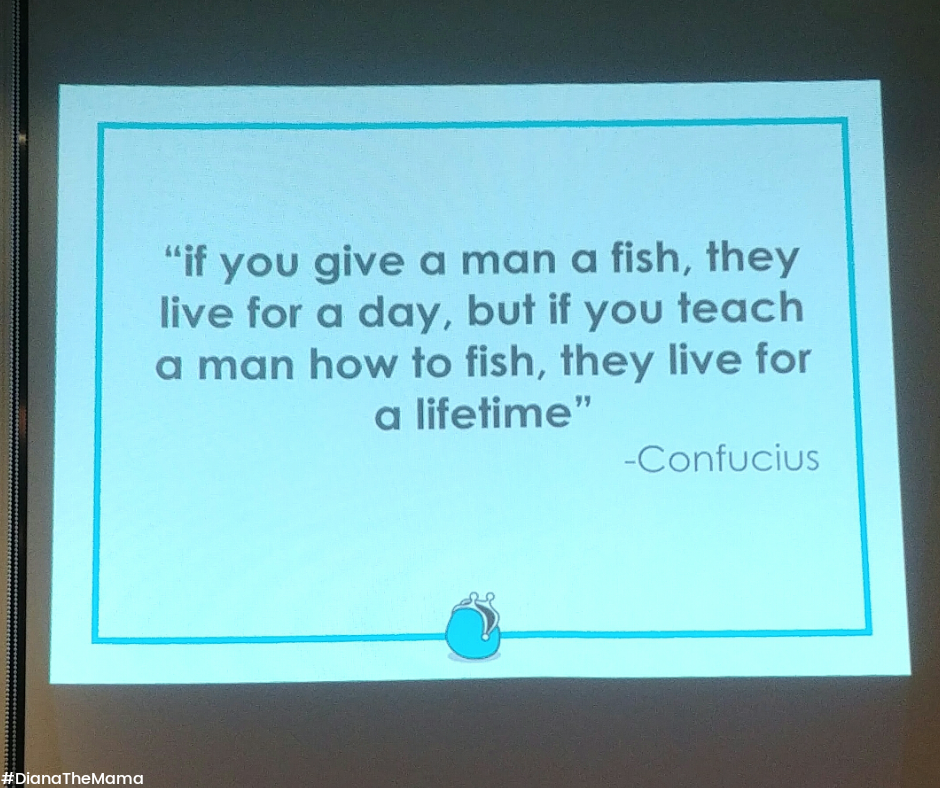

Sharing with you some more pabaon quotes and Bible scriptures shared by Mommy Gracie during the half-day workshop. Hoping these could also encourage us, esp. moms and dads to practice proper money management in our homes. 🙂

Should you have any additional info or suggestions, feel free to comment down or email me. 🙂

Meanwhile, Mamacademy PH has an upcoming Workshop on Purpose-Filled & Effective Blogging, with Ms. Bea Patricia Jalandoni as their speaker on August 25, Saturday.

Hurry and register now on this link as there are only a few slots left!